Download the 3.17.23 Dynamic Market Update for advisors’ use with clients

By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management

Economic Checkup: Still Healthy

While Silicon Valley Bank (SVB) may have dominated headlines this week, there were a couple of major economic data releases that were almost overlooked! If you are interested in more information on the SVB situation, please refer to our Special Market Update published earlier in the week. But in this update, as always, let’s focus on the data:

- The Jobs Report Hit the ‘Sweet Spot.’ The U.S. Labor Department reported that non-farm payrolls rose by 311,000 in February, beating expectations. This is a sign of a continuing healthy labor market and economic resiliency. Normally, this would have ignited some renewed inflation fears, but there were a couple of disinflationary signals in the report. First, unemployment rose to 3.6%, slightly above expectations. Second, wage growth climbed at 4.6%, below expectations and the third straight slowdown in month-over-month growth.

This report hit the sweet spot, indicating a best-of-both-worlds situation with a healthy economy and reduced inflation pressures—ultimately supportive of a milder economic downturn, as opposed to something more severe.

- Inflation Continued to Drop. The U.S. Labor Department had another bit of good news. The Consumer Price Index (CPI), a primary measure of inflation, grew at an annual rate of 6%, marking the eighth consecutive monthly drop in the growth rate. Investors welcomed the data with open arms and a market rebound.

With continued inflation drops, the Federal Reserve (Fed) inches closer to the end of their interest rate hike cycle. The expectations for only a 0.25% hike at the next meeting (as opposed to 0.50%) increased after the CPI data release, which should be supportive for both the stock market and economy.

Watch What You Watch

The main event to watch this past weekend was of course, the Oscars! I absolutely loved “Everything Everywhere All at Once” and was happy to see it sweep so many categories. I will admit, I teared up when I saw Indiana Jones and Short Round reunited on stage for the Best Picture award.

I hope that Everyone Everywhere enjoyed the Oscars. Unfortunately, though, I think most investors were glued to the news about SVB and Signature Bank closures. The sensationalized coverage of these events created extreme volatility that shook markets. Emotion, fear, group think and other tendencies that lead to irrational investment behavior were exhibited. Like usual, I’m going back to the Warren Buffett quotebook:

“Be fearful when others are greedy, and greedy when others are fearful.”

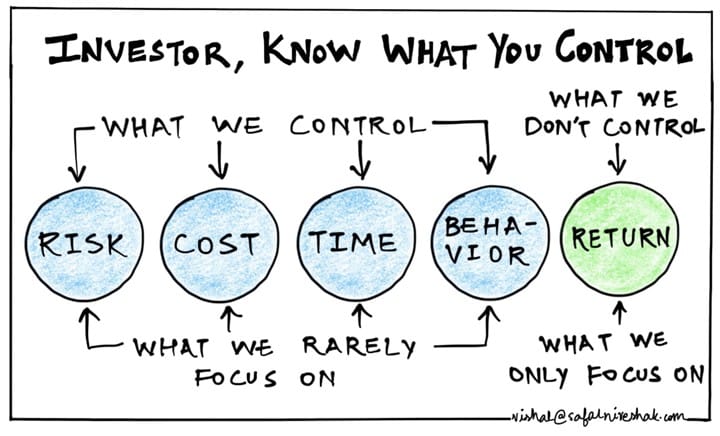

If everyone around you is in a state of panic, it’s not easy to stay calm. These are the times where an advisor’s value really shows its worth. According to Vanguard’s Advisor’s Alpha® Perspectives, “Putting a value on your value: Quantifying Vanguard Advisor’s Alpha®,” advisors often add the most value to their clients through “behavioral coaching.” And one of the best ways to avoid bad investment decisions is to focus on what you control (and turn off the TV!):

- Investors Control Many Things. You control how much money you save and spend, the types of investments you select (high risk/low risk) and believe it or not, your emotions. But we tend to rarely focus on these things.

- Investors Focus on One Thing. Investors instead tend to spend most time focused on market returns. Returns are certainly important in the long run but are completely out of our control.

- Focus on What You Can Control. Daily stock prices and market fluctuations are not under anyone’s control and are not of significant importance to long-term investment goals. Investing is a long-term endeavor, and over the long term, the things that you can control are of much higher importance to investment success.

Source: Safal Niveshak, “What We Control, and What We Don’t”

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicwealthadvisors.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Mirko Fabian, Unsplash