Download the 1.6.23 Dynamic Market Update PDF for advisors’ use with clients

By Kostya Etus, CFA®, Head of Strategy, Dynamic Investment Management

What’s the market hoping for in 2023?

The market had a lot of problems in 2022 and is looking for some resolutions to come in 2023.

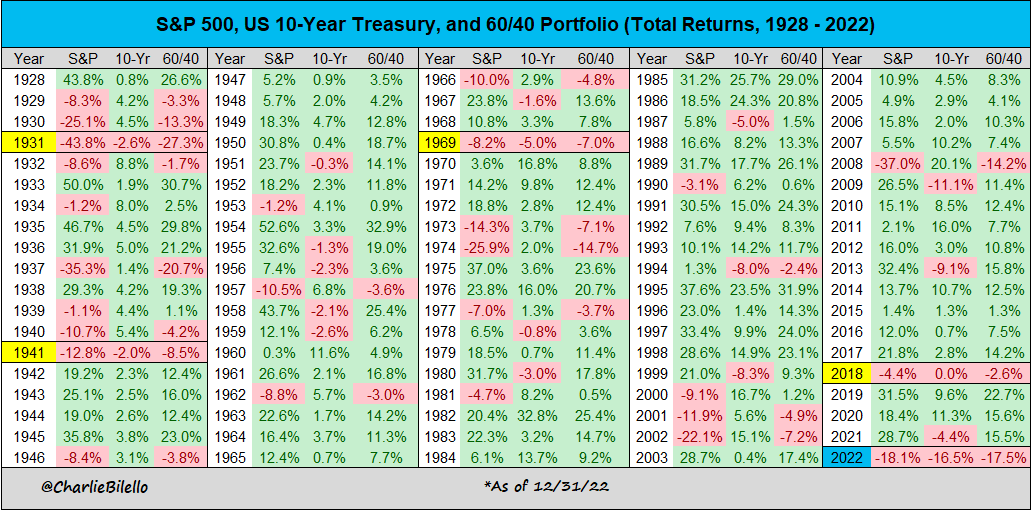

As per the performance table below, “Stock Market, Bond Market and 60/40 Portfolio,” there were few places for investors to hide in 2022. Perhaps the following resolutions could help us reverse this trend in the new year:

- Moderated Interest Rates: While rates may remain elevated, the hope is that the frequency and size of hikes will come down and we’ll establish a level in which everyone is comfortable.

- Lower Inflation: It’s a relative game. Inflation may persist but directionally, should continue to move lower as the heightened interest rates slow things down.

- Improved Supply Chains: Consumer demand is still strong, and production lines continue to improve and expand to supply those goods and services.

- Decreased Pandemic Cases: COVID is still an issue across the globe, but just like in the U.S., it will continue to get better with time.

- Resolved Geopolitical Conflict: At this point, just about any favorable sentiment from the Russia/Ukraine conflict with be beneficial for global markets and economies.

BONUS: No Recession. The job market remains strong, the housing market has settled down, the Fed is cautious in its approach with interest rates and consumers are still spending money. These signs point to a potential of a “soft-landing” in which the Fed puts out the fire of high inflation without creating a drought for the economy.

Forget 2022 and look to the future

2022 was truly a remarkable year. Remarkably terrible for the markets, that is. We know it’s rare for stocks and bonds to fall together, but to fall by the magnitude that we experienced in 2022 has never been seen before.

Given the cyclicality in the markets, it’s unlikely that we’ll see this performance continue for too long, and we may see bright skies ahead. If nothing else, the power of diversification, and the relationship between stocks and bonds, should start to revert back to normal.

But to see how truly unique 2022 was, let’s take a look at annual returns for stocks and bonds, dating back to 1928. Here are some fun stats from the data:

- Stocks and bonds were both down in only five calendar years. (1931, 1941, 1969, 2018, 2022)

- Stocks and bonds were both down more than 10% in only one year! (2022)

- Stocks had their fifth largest loss in history. (1931, 2008, 1937, 1774, 2002)

- Bonds had their worst year in history. (2022, 16.5%)

- The 60/40 had its third worst year in history, and the other two were in the ’30s. (1931, 1937, 2022)

Again, these numbers from 2022 are truly unprecedented and we’re looking forward to more normalcy in the future.

Stock Market, Bond Market and 60/40 Portfolio

Annual Returns 1928-2022

Source: Charlie Bilello, as of 12/31/22. Past performance is no guarantee of future results.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicwealthadvisors.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: iStock