By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management

First Quarter Stock Market Strength

The U.S. stock market had a historically strong first quarter to kick off 2024 with a 10.6% total return for the S&P 500 index. This was the best first quarter since 2019 and one of the best in history (more on this below). There were a whopping 22 new all-time market highs with surprisingly low volatility. And all this with the headwind of the higher-for-longer interest rate rhetoric from the Federal Reserve (Fed). How was the market able to accomplish these feats?

Let’s review the key items that we experienced in the first quarter which may have helped drive returns:

- Optimism over the economy, as expectations from investors are for a “soft landing”, meaning moderating inflation without a severe recession.

- Expectations for lower rates, despite indications of fewer or delayed interest rate cuts, the Fed still holds a dovish stance, expecting to cut rates later this year.

- Inflation continues to moderate, broadly speaking, as we see continued reports of falling prices.

- Energy stocks have rebounded, benefitting from rising oil prices which reached their highest levels in almost ten years.

- Artificial intelligence continues to boom, as other companies outside of the tech sector start to realize its full business opportunities.

These trends, which helped support market performance in the first quarter, are not short lived. They may all continue to provide tailwinds for the remainder of the year and beyond.

What About the Rest of the Year?

As mentioned above, the stock market hit some significant milestones in the first quarter. But is there any correlation between what happens in the first quarter to the rest of the year?

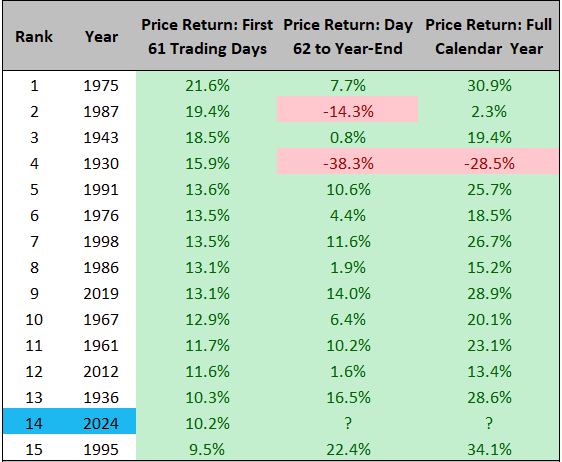

To answer this question, let’s look at market data going back to 1928 to see what history can teach us:

- The Top 15 List: There have only been 14 double digit first quarters and 2024 made the list! Interestingly, it’s the third time we’ve seen such strong quarters in recent history (2012 and 2019).

- A Positive Relationship: In all but two instances, the remainder of the year showed positive performance. The returns were not always as strong as the first quarter, but they were generally positive.

- Strong Annual Returns: When there was historically a strong first quarter, there has typically been a strong year. The one outlier happens to be the Great Depression (1930). Additionally, as 1987 shows (which is the year of the historic market crash), a strong first quarter can help preserve annual gains even if there happens to be some weakness in the remainder of the year. Overall, the outlook for 2024 appears to be favorable.

Stay diversified, my friends.

Stock Market Best Performance Through the First Quarter

S&P 500 Index Price Return From 1928 – 2024

Source: Bilello.Blog by Charlie Bilello. As of 3/29/24. Data from 1928-2024. Past performance is no guarantee of future results. https://bilello.blog/2024/the-week-in-charts-4-1-24

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock