Download the 1.20.23 Dynamic Market Update for advisors’ use with clients

By Kostya Etus, CFA®, Head of Strategy, Dynamic Investment Management

Off To a Good Start

We are leaving 2022 behind and starting out fresh in 2023 with two positive performance weeks in a row for the stock market. Investors are optimistic after receiving favorable inflation data. The year-over-year consumer price index (CPI) growth fell to 6.5%, the lowest level since October 2021, and the sixth consecutive drop. More importantly, core inflation (which excludes more volatile food and energy prices) fell to 5.7%, its slowest pace in more than a year and the third consecutive drop.

The reason for optimism is it increases the expectations of a soft landing. Meaning the Federal Reserve (Fed) has raised interest rates just enough to slow inflation, and not throw the economy into a recession. The data also increases the chances of a smaller 0.25% hike at the next Fed meeting on February 1 and one final hike in March to bring the rate to around 5%, matching market expectations and Fed projections.

After March, the Fed may pause and evaluate economic conditions based on inflation, the job market and economic strength. The current trajectory of consistently lower inflation would suggest that the rate hikes are near an end and the economy potentially avoids a severe recession.

Diversification Works!

If the expectations for a Fed pause are correct, what are the implications for the market? Looking at historic data within BlackRock’s January 2023 report, “Student of the Market,” when the Fed stops hiking rates, it’s a catalyst for both stronger stock returns and bond returns. As we know, the traditional 60/40 stock/bond portfolio had a historically tough year (see the January 6 Market Update); it could be poised for a rebound in the year to come.

You’ll often hear in the media that the “60/40 is dead” or “diversification no longer works,” something that’s not new. Diversification doesn’t always feel good over the short-term, but if you take a step back and look at the long-term view, diversification often wins.

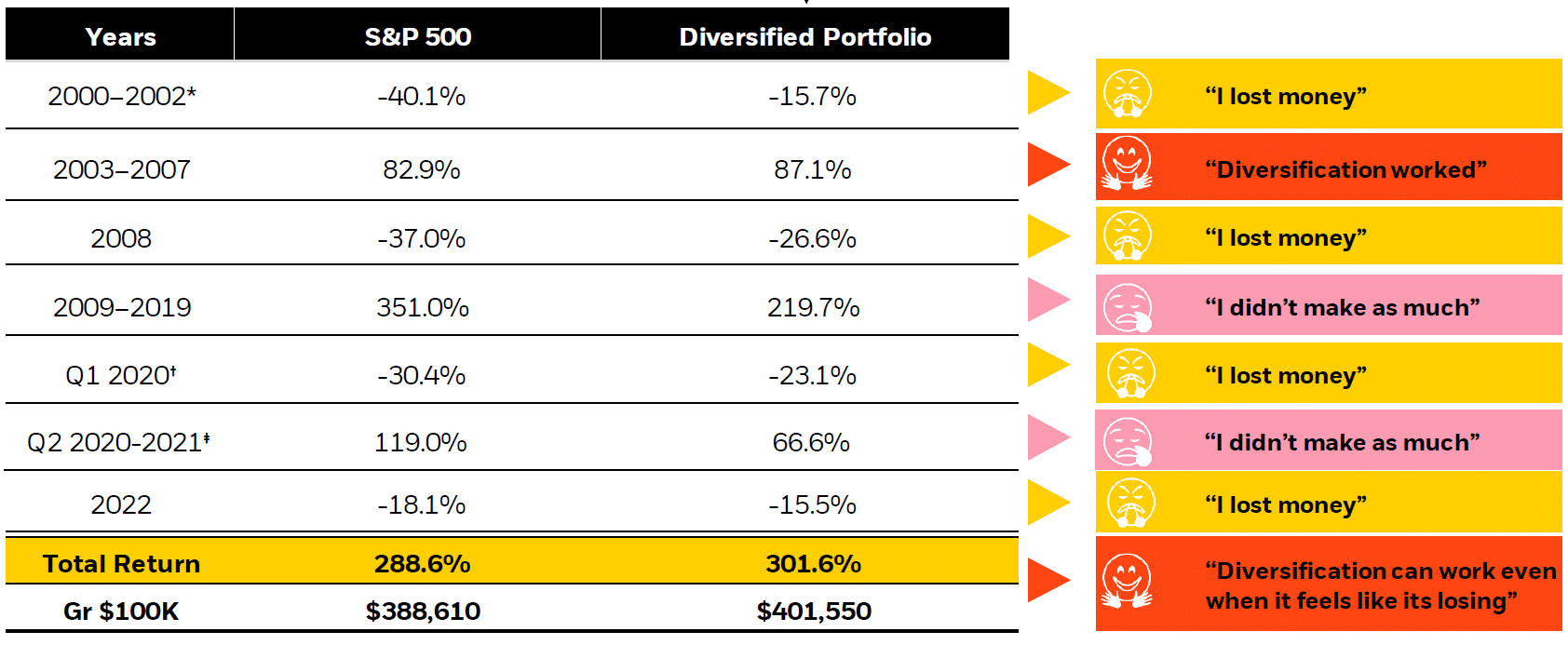

Let’s evaluate the ups and downs of the market over the last 20 years and have an apples-to-apples matchup between the S&P 500 and a diversified portfolio. In the chart below, “A Diversified Portfolio Can Work, Even though It Never Feels Good,” a few things stand out:

- Bad Years: When the overall market is down, investors often don’t care as much about the magnitude of the loss. They’re simply upset that, “I lost money.” AKA: Loss aversion, the pain of losing is more powerful than the pleasure of gaining.

- Good Years: During a strong bull market, all of a sudden the magnitude of gains becomes very important to investors and they’re upset that, “I didn’t make as much” (as the S&P 500 or my neighbor’s latest hot stock pick). AKA: Fear of Missing Out (FOMO).

- And the WINNER is…The diversified portfolio! Diversification DOES work over the long-term because investors don’t lose as much during the down years and can rebound and compound faster during the up years, resulting in stronger risk-adjusted returns over the long-term (typically higher returns with lower risk). AKA: Win more by losing less.

A Diversified Portfolio Can Work, Even though It Never Feels Good

(Last 20+ Years)

Diversified portfolio example: 25% U.S. large stocks, 19% U.S. mid cap stocks, 7% international stocks, 5% U.S. small cap stocks, 4% emerging market stocks, 25% U.S. bonds, 15% high yield bonds.

Source: Source: Morningstar as of 12/31/22. *Performance is from 9/1/00 to 12/31/02. †Performance is from 1/1/20 to 3/23/20. ‡Performance is from 3/24/20 to 12/31/21. Diversified Portfolio is represented by 25% S&P 500 Index, 19% Russell Mid Cap Index, 7% MSCI EAFE Index, 5% Russell 2000 Index, 4% FTSE Emerging Stock Index, 25% Bloomberg US Aggregate Bond Index, 15% Bloomberg US Corporate High Yield Index. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in the index.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicwealthadvisors.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Pascal Meier, Unsplash