By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management

Labor Market Update

August was a relatively flat month in terms of stock market performance as investors contemplated the potential next moves from the Federal Reserve (Fed): To hike or not to hike? That is the question.

To help answer that question, we received three important labor market reports last week:

- Job Openings and Labor Turnover Survey (JOLTS). This report provides two key indicators for the overall labor market: job openings and quits rate. Both measures fell in July, below expectations, and to the lowest readings since the pandemic (March 2021). With less openings, and less people quitting, it may be an indication of a softening labor market.

- Automatic Data Processing (ADP) Private Payrolls. Total job gains came in below expectations and were more consistent with the levels of job creation that we saw before the pandemic. A sign of a return to “normal.” More importantly, the report showed softer wage growth, the slowest since October 2021. Since wage growth is a key component of inflation, this may be an indication of lower inflation to come.

- U.S. Bureau of Labor Statistics Non-Farm Payrolls. Most notable information from this report was the uptick in unemployment to 3.8%, the highest since February 2022. This again points to a softening labor market, although the current unemployment rate is still relatively low compared to history.

What are the key implications for the Fed, economy and markets?

- Fed. The slowdown in the labor market and potentially lower inflation adds to the case for the Fed to not hike interest rates further and hold steady. And it increases the chances of rate cuts sooner.

- Economy. While the labor market is softening, it’s doing so steadily and is still healthy compared to historical trends. For now, we are simply getting back to pre-pandemic levels. This may suggest a “Goldilocks” scenario of a “not too hot, not too cold” labor market which allows the economy to avoid any significant slowdown or meaningful recession.

- Markets. The expectations of steady-to-lower interest rates, continued lower inflation and the potential for a milder recession are all supportive for both stock and bond market returns in the future.

Client Concerns Corner: China Comments

We often receive questions about global markets and economies and are always eager to provide input. Our main goal is to make sure our clients are comfortable with their investments and understand how Dynamic strategically manages global, diversified and balanced portfolios focused on the long-term.

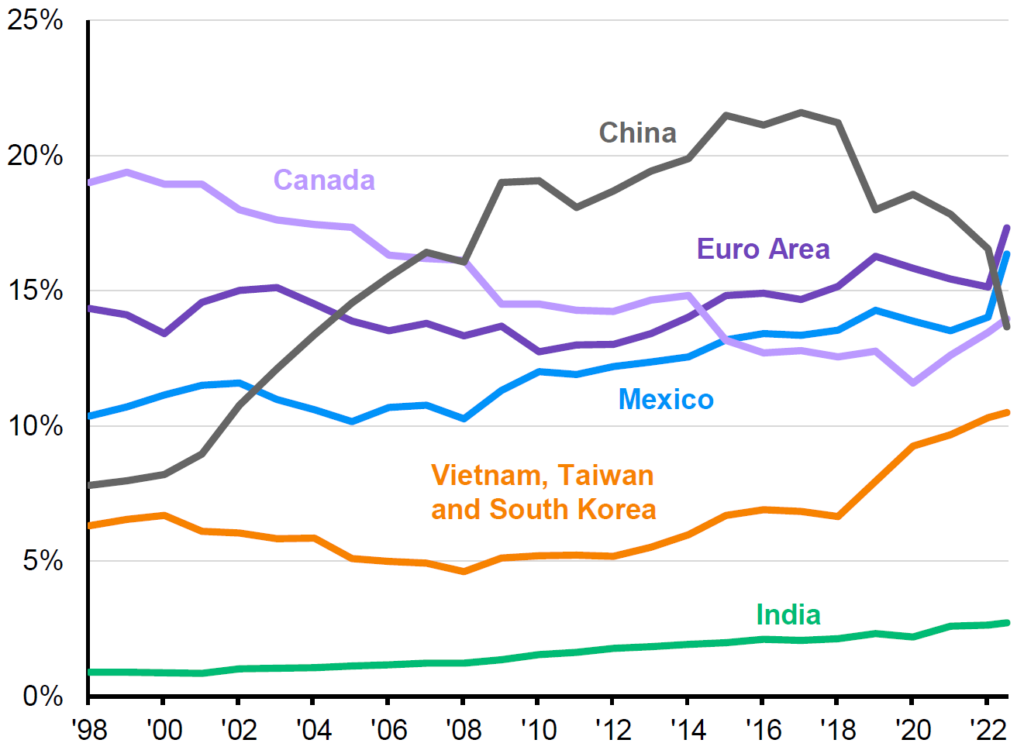

Recently, we’ve been getting questions about the issues in China and their impact on the U.S. The reality is that the U.S. dependence on China has meaningfully decreased over the past several years. There are many reasons for the reversal of trend in China imports, including: Ukraine-Russia war, China-U.S. relationship tensions, tariff disputes, pandemic impacts and supply chain issues. However, as the “U.S.’s Largest Sources of Imports” graph below illustrates, for the first time since 2008, China is no longer the U.S.’s largest source of imports.

What are the benefits of U.S. import restructuring?

- Nearshoring. Because of the pandemic and resulting supply chain disruptions, there’s been a push to move manufacturing closer to the U.S., including Canada and Mexico. This helps to reduce shipping costs and uncertainties around delivery timelines. In many cases, manufacturing was brought within U.S. borders—helping to enhance efficiencies and reduce overall costs.

- Friendshoring. It’s always better to trade with friends who have your interests in mind. The U.S. has also shifted manufacturing to some of the places with stronger diplomatic relationships including the euro area and other emerging Asian economies such as India. The U.S. benefits from potentially lower manufacturing costs, a more robust integration in global supply chains and more attractive corporate taxes.

- Diversification. Companies in the U.S. are wise to diversify their dependence on China by partnering with other countries. First off, they benefit from the unique advantages of other regions. But more importantly, they can avoid the risk of being dependent on a single country. Just like everything else related to investing, a more diversified approach often results is better outcomes.

Stay diversified my friends.

U.S.’s Largest Sources of Imports

(Percentages of U.S. Goods Imports, 1998 to YTD 2023)

Sources: FactSet, U.S. Census Bureau, J.P. Morgan Asset Management. Past performance is no guarantee of future results.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock