By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management

The Great Debt Debate

Happy Friday the 13th! But more importantly, Happy Birthday to me! It’s a fun birthday to have during Halloween month.

Speaking of scary times, recent headlines have been heavy with debt-related investor concerns. The government has too much debt, companies have too much debt, consumers have too much debt, etc. Are we in a debt crisis?

I think a better question to ask: Is debt a bad thing? Within companies, lower debt ratios are often associated with higher quality. But debt may be necessary for growth. Companies borrow money to grow their operations (build new offices, hire more employees, research new products, etc.) and thereby, grow their earnings.

So perhaps it’s not necessarily how much debt a company has, but instead how easily the company can cover interest payments through their profitability. For a consumer example, think about a home mortgage. It’s not necessarily what is owed, but what is paid monthly to service the debt versus wages earned.

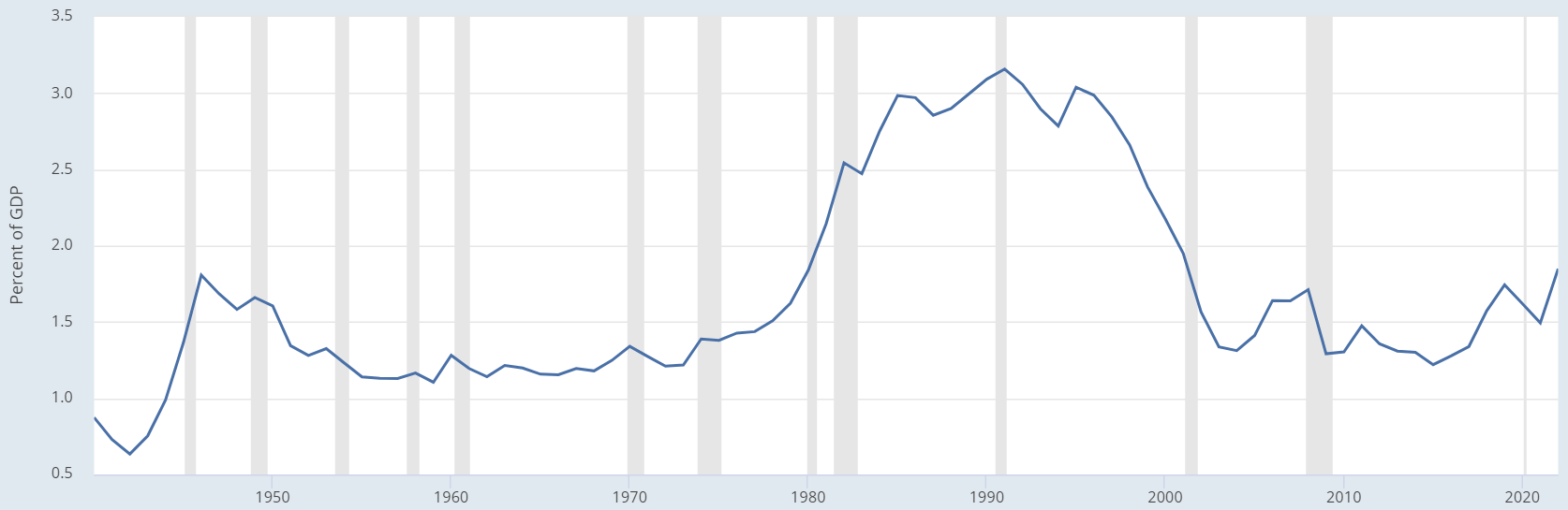

Let’s consider government debt. Nobody likes to see U.S. debt at $33 trillion. But what’s the debt service obligation relative to overall growth in wealth? The “Federal Outlays” graph below shows that U.S. interest as a percentage of gross domestic product (GDP) is currently well below the 3%-plus seen in the 1990s.

Bottom line, given companies are still profitable, wages for consumers are growing and government debt appears manageable, we don’t foresee debt in a crisis. It may very well be a headwind for future growth, but not something crippling.

With the reduction in inflation over the past year, strong labor market, resilient consumer, and potentially a peak for interest rates, we could see the avoidance of severe recession for the economy (soft landing) and some potential upside for the markets (stock and bond) going forward.

Federal Outlays: Interest as Percent of Gross Domestic Product (GDP)

Source: OMB; St. Louis Fed. Shaded areas indicate U.S. recessions. Past performance is no guarantee of future results.

Market Performance Around Crisis Events

In other scary news, Israel was attacked by a Palestinian militant group, impacting markets due to geopolitical concerns across the Middle East. This is a truly tragic event, but investor fears were primarily centered around oil prices going higher, leading to more inflation. But how much impact do these crisis events really have on the market over the long term?

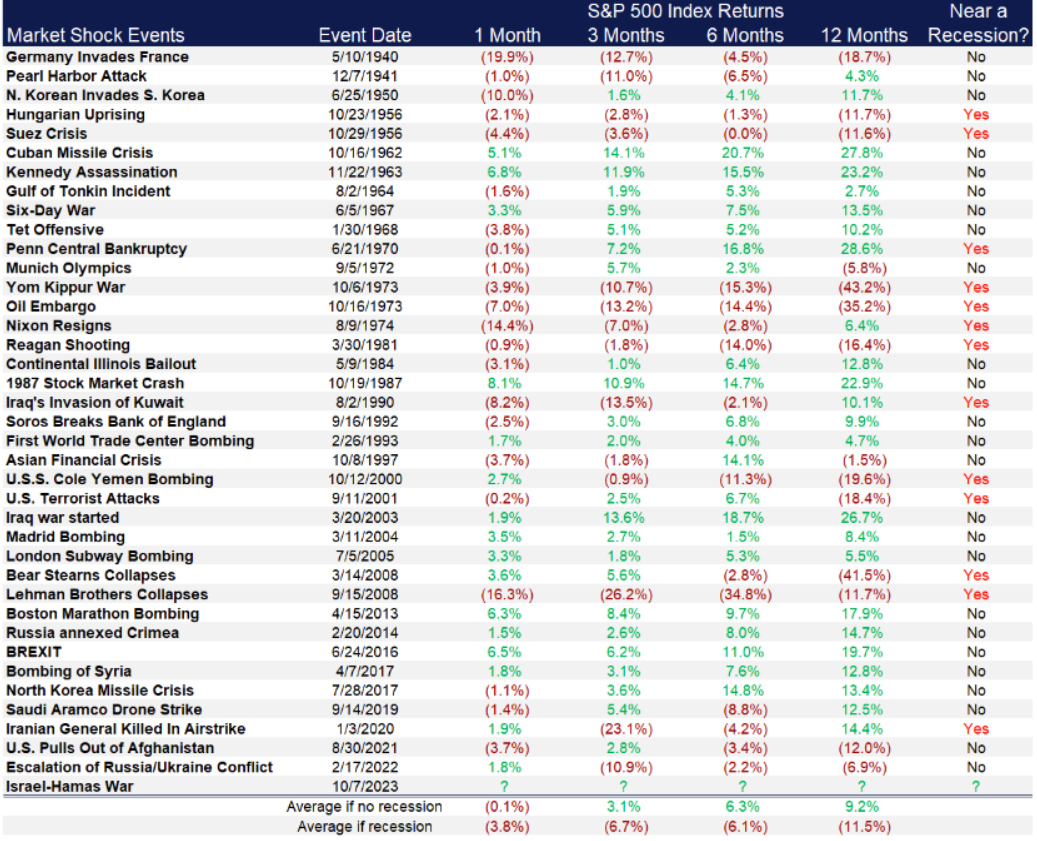

To help answer this question, the chart below, “How Do Stocks Perform after Major Events?” highlights some key geopolitical events since 1940 and the impact to the market over various time periods:

- Investor Emotions – Also known as “fear,” resulted in a negative average return during the crisis events. However, over the following month, three months, six months and year, the returns were positive in non-recession periods.

- Market Resiliency – The loss of the initial reaction was often netted out quickly. As history has shown, while crisis events elicit an emotional response, the stock market has a general resiliency to move upward, and crisis events often prelude strong forward market returns.

- Long-Term Outlook – “In the short run, the market is a voting machine but in the long run it is a weighing machine.” Benjamin Graham reminds us to focus on fundamentals. In the short term, there’s often market turmoil driven by news headlines and fear. But in the long-term, the market is driven by fundamentals, which remain strong in the current environment.

Stay diversified my friends.

How Do Stocks Perform after Major Events?

(S&P 500 Index Performance after Select Major Geopolitical and Historical Events)

Source: LPL Research, Bloomberg, Factset, S&P Dow Jones Indices, CFRA, Strategas 10/09/23

All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

The modern design of the S&P 500 Index was first launched in 1957. Performance before then incorporates the performance of its predecessor index, the S&P 90. Past performance is no guarantee of future results.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock