By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management

Trick or Treat: Rising Bond Yields

Happy Halloween!

Both stock and bond markets have seen an increase in volatility recently as the iconic 10-year Treasury yield crossed the 5% level for the first time since 2007. But yields went up across the spectrum from the two-year all the way to the 30-year, which is particularly impactful for mortgage rates as the average 30-year mortgage rate jumped close to 8%, near the highest level since 2000.

But these higher yields may not necessarily be a bad thing. Let’s evaluate why they’re rising and what the implications may be for the future:

- The economy is too healthy. A resilient labor market and a strong consumer have resulted in economic growth beating expectations, which may not have been difficult given many economists were predicting recessionary conditions. This certainly doesn’t sound like a bad thing, but yields do tend to move in tandem with economic growth prospects.As the economy cools in the quarter’s ahead, we could see yields move lower as a result.

- Too many bonds, not enough buyers. The growing U.S. government debt has resulted in an increase in Treasury bonds in the market. Meanwhile, other countries such as Japan have increased their yields, attracting more buyers away from the U.S.As U.S. yields increase, it should result in more demand from both domestic and international buyers, putting downward pressure on yields.

- One more hike? There’s still the possibility for one more hike from the Federal Reserve (Fed) this year, which is helping keep yields higher. But the expectations are largely that this will be the last rate increase, and we could potentially see rate cuts next year.As we near the end of the Fed rate hike cycle, we could be seeing peak levels for interest rates across the curve and the potential for lower yields soon.

The Real Surprise: It’s Rare for Bonds to be Down

Continued increases in interest rates this year have brought bond prices down, resulting in negative year-to-date returns for the Bloomberg U.S. Aggregate Bond Index. This could potentially mark the third consecutive year of negative bond returns.

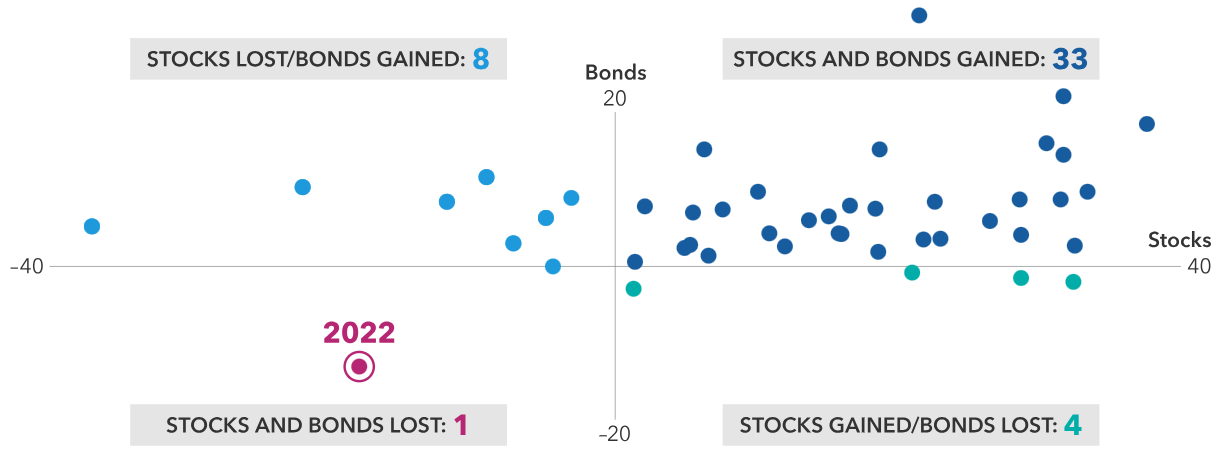

How rare is this? And what’s the potential opportunity? Let’s evaluate with the “Stock and Bond Return Distribution” chart below:

- Bonds rarely lose. Prior to 2021, bonds have only been negative three times in 46 years. And when bonds were down, it was not by much. So, bonds potentially being down in three consecutive years (2021, 2022 and 2023) is truly unique. The beauty of bonds is they eventually have to return to par value, so the more they fall, the higher the potential for them to rise. This sets up for an attractive opportunity for bonds in the current environment.

- Stocks don’t lose too much either. It’s refreshing to see that stocks were only down nine of 46 years, that’s an 80%-win rate—you can’t get that at the casino and it’s certainly better than a coin flip. But the main difference between stocks and bonds is the magnitude of some of the down years for stocks is much more significant (one is close to -40%).

- Mixing stocks and bonds is the best way not to lose. With the exception of 2022, there has not been a year since 1977 where both stocks and bonds were both down, an anomaly. Every other time that stocks were down, bonds were up (often with strong returns). And vice versa, poor bond performance was often met with strong stock performance. Most importantly, note that the majority of dots is in the quadrant with both stocks and bonds outperforming, reminding us that staying diversified and invested for the long-term is the best way to reach investment goals.

Stay diversified, my friends.

Stock and Bond Return Distribution

Percentages from 1977-2022

Sources: Capital Group, Bloomberg Index Services Ltd., Standard & Poor’s. Each dot represents an annual stock and bond market return from 1977 through 2022. Stock returns represented by the S&P 500 Index. Bond returns represented by the Bloomberg U.S. Aggregate Index. Past results are not predictive of results in future periods.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock