By Bill Smith, Fixed Income Trader and Portfolio Manager

With the Federal Reserve (Fed) telegraphing three rate cuts this year, and Bloomberg’s probability model estimating at least five as of January 23, we will likely see lower rates in 2024. If this scenario plays out, fixed income should perform well, as bond prices generally rise when rates fall. This is especially true for intermediate and long bonds, which typically outperform short maturities when rates drop. Given this dynamic, an allocation to longer maturities appears prudent for individual fixed income portfolios. While there are numerous ways to attain long exposure, bullet, barbell and laddered strategies are the most common. Each has a distinctly different structure that should be considered when deciding between strategies.

Bullet – Specific Maturity Target

As the name suggests, a bullet strategy involves purchasing bonds with a specific maturity target. For instance, an investor might focus exclusively on one-year bonds, or only invest in twenty-year maturities. While this is one of the simplest strategies to execute, its focus on a specific maturity range means it is also the least flexible. Furthermore, longer bullet strategies carry significant interest rate risk, and force investors to make a bet on a single point on the yield curve. As such, bullet strategies are typically best for shorter time horizons when planning for future liquidity needs. For example, if you are sending a child to college in three years, you can buy three-year bonds that mature before the first tuition payment is due.

Barbell – Skip the Middle

While barbell strategies come in all shapes and sizes, most involve allocating capital to shorter term maturities, avoiding intermediate and investing in long. The longer end of the barbell provides duration exposure and offers more certainty around future cash flows, while the short end lowers overall portfolio volatility and provides more flexibility as bonds mature. Just like a bullet, barbell strategies involve making specific yield curve bets by excluding intermediate bonds, resulting in a portfolio that is overweight both short and long bonds.

Ladder – Broad Exposure

In a laddered strategy, investors attempt to evenly distribute maturities across their investment horizon, providing exposure to short, intermediate and long bonds. When the shortest bond in the ladder (rung) matures, proceeds are reinvested into the longest end, keeping duration relatively stable. While the length of both barbells and ladders can be customized, a laddered strategy does not make specific yield curve bets over its investment horizon. Once the length of the ladder is established, broad exposure is the goal.

Choosing a Strategy

Selecting an appropriate strategy will largely depend on each investor’s unique situation. That said, we believe a diversified approach to maturity selection is prudent and would exercise caution when considering a bullet strategy for long bond exposure. Along those lines, barbells also take a less diversified approach to maturity selection and typically exclude intermediate bonds. Balancing the duration of a barbell also requires a significant allocation to short maturities, increasing reinvestment risk and potentially leading to underperformance in a falling rate environment. Since a laddered strategy offers broad diversification across the yield curve and can be built to reduce short maturity exposure, we expect most laddered structures will perform well if rates fall.

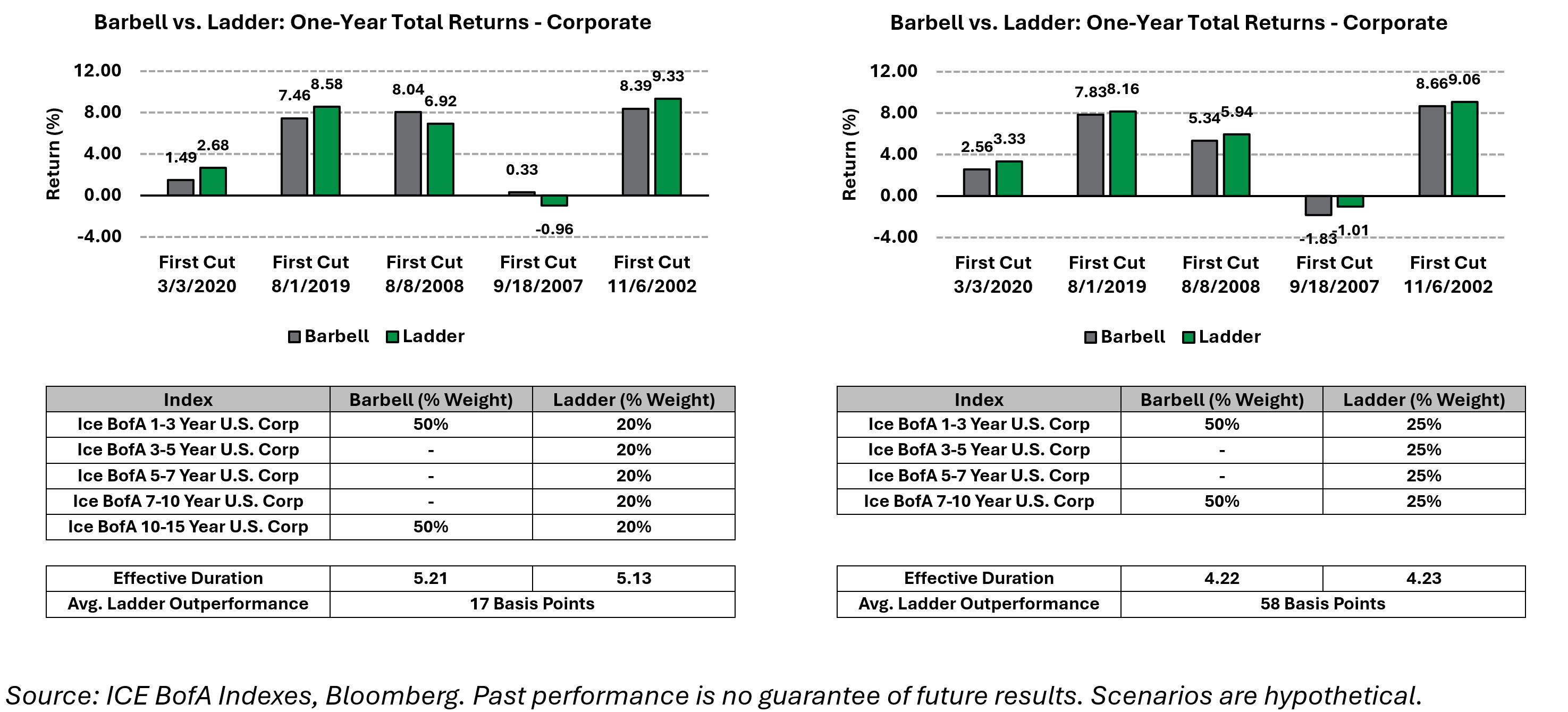

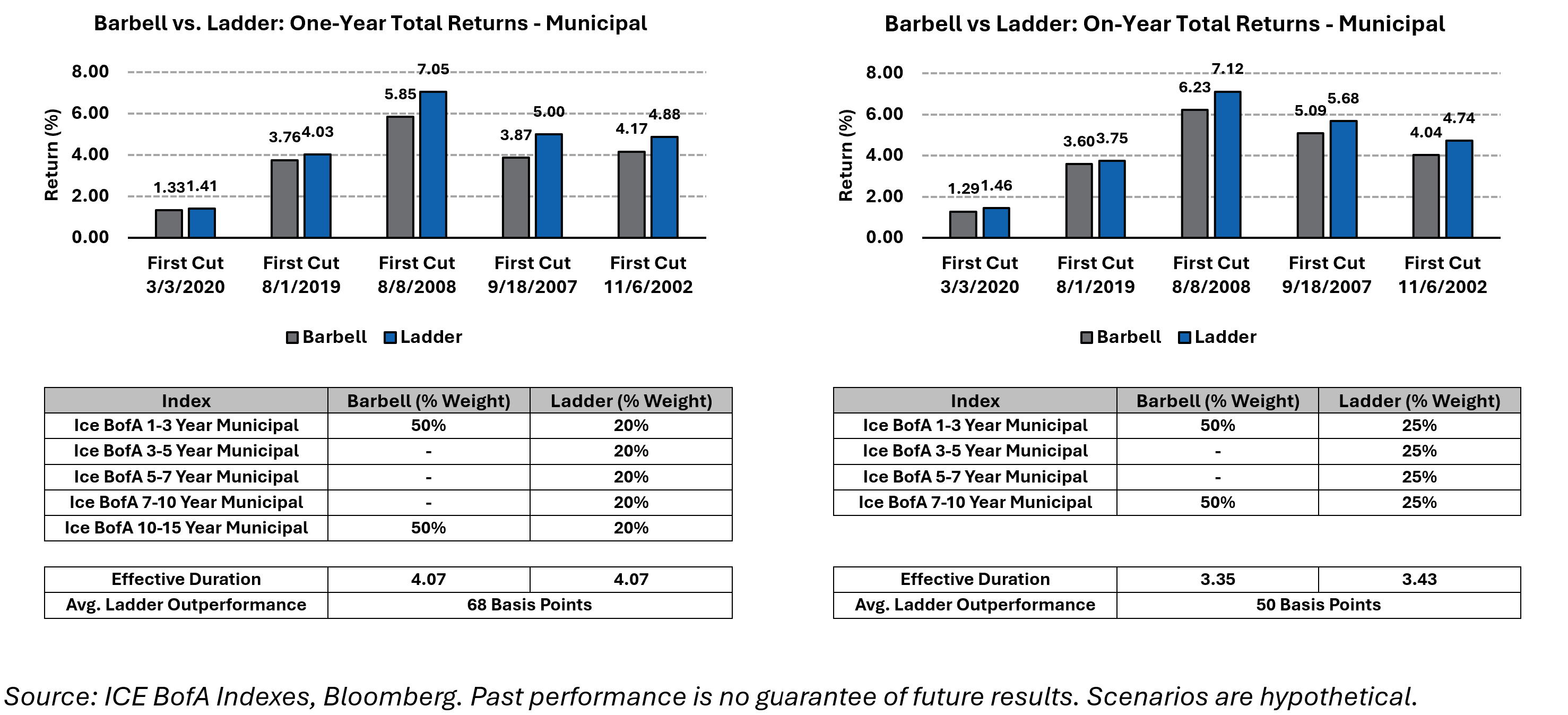

To help illustrate this point, we analyzed the historical performance of several municipal and corporate bond portfolios at the beginning of previous Fed easing cycles. For this analysis, the charts below, “Municipal Scenarios” and “Corporate Scenarios,” focus exclusively on barbell and laddered structures:

Municipal Scenarios

Corporate Scenarios

While not exhaustive, this analysis demonstrates that when durations are similar, ladders have the potential to outperform barbells in a falling rate environment. With attractive yields available across fixed income sectors and maturities, a diversified maturity distribution should be an important consideration when building fixed income portfolios.

A prudent approach to fixed income investing calls for diversification across both credit and duration exposure. As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating fixed income for your clients, please contact Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Bill Smith serves as president, Portfolio Management & Trading, of Harmont Fixed Income in Phoenix.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock