By Bill Smith, Fixed Income Trader and Portfolio Manager

While changes in monetary policy are always good for a headline, March has been particularly notable for central banks across the globe. The Bank of Japan raised rates for the first time since 2007. The Swiss National Bank surprised markets with a 25-basis-point cut. Even the U.S. Federal Reserve added to the excitement, maintaining a call for three rate cuts this year despite a recent run of hotter-than-expected U.S. inflation data. As we move further into 2024, and more central banks contemplate shifts in monetary policy, we expect headline-making events have just begun.

The End of an Era: Bank of Japan Hikes Rates to Zero – 0.1%

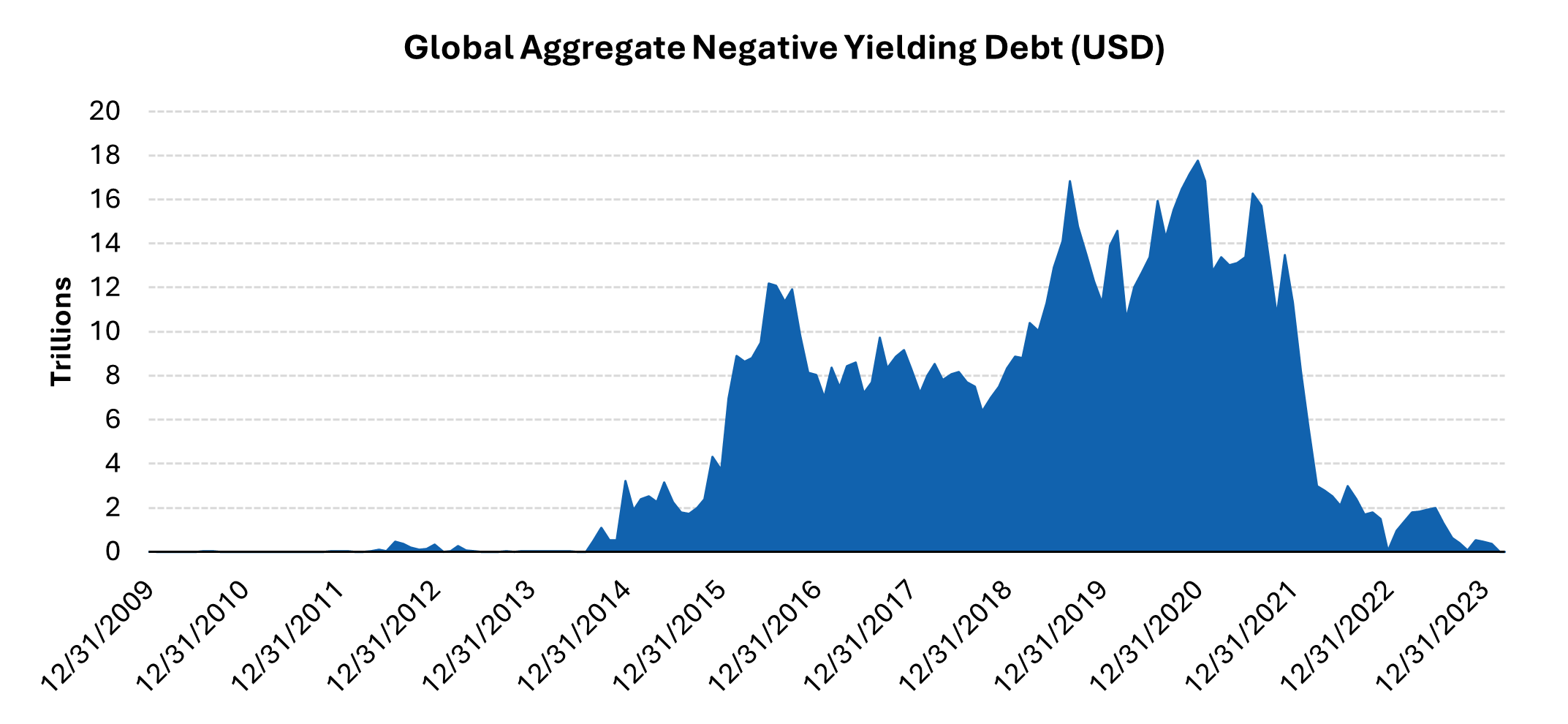

The negative interest rate experiment that began with Denmark’s central bank in 2012, and eventually grew to include the European Central Bank, as well as central banks in Japan, Sweden and Switzerland, has officially ended. The Bank of Japan, the last remaining central bank with a policy rate below zero, moved into slightly positive territory last Tuesday. This marks Japan’s first interest rate hike in seventeen years, and the first time rates have been positive since 2016. It should also close, at least for now, the chapter on negative yielding debt, which peaked around $18 trillion in 2020.

Source: Bloomberg. Past performance is no guarantee of future results.

First Mover: Swiss National Bank Cuts to 1.50%

On March 21, the Swiss National Bank (SNB) surprised markets with a 25-basis-point cut to the SNB policy rate, citing a belief that “the fight against inflation over the past two and a half years has been effective.” This is the first rate cut from a major central bank this year and may very well mark an inflection point from tightening to easing as other central banks look to follow suit.

Fed Holds Rates Steady at 5.25 – 5.50

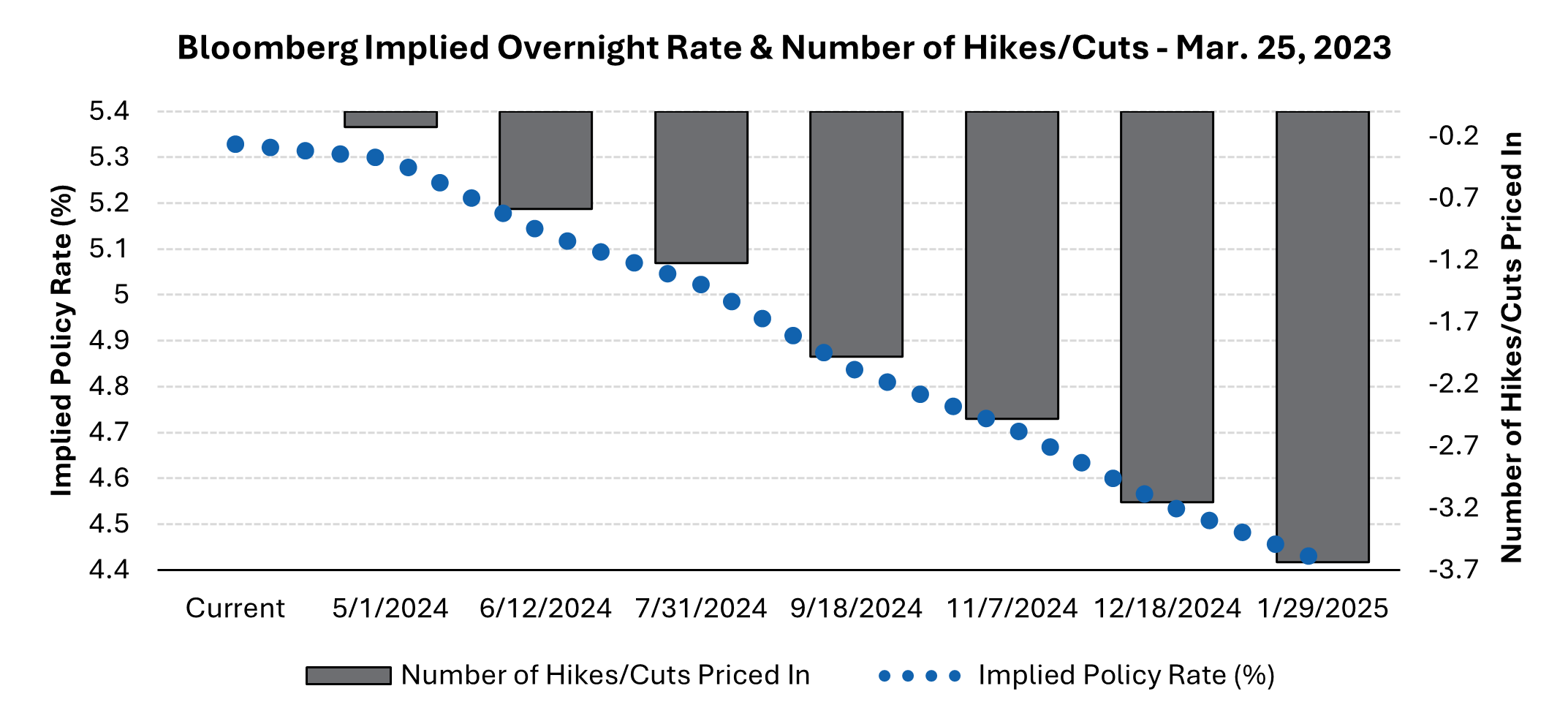

In a widely anticipated move, the U.S. Federal Reserve (Fed) held rates steady at last week’s Federal Open Market Committee Meeting, where Fed Chair Jerome Powell reiterated, “Our policy rate is likely at its peak for this tightening cycle and that, if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.” Interestingly, the Fed’s median projection for rate cuts remained unchanged. The Fed’s “Dot Plot” still calls for three 25-basis-point cuts this year despite a recent spate of elevated U.S. inflation data, and a slight increase in the Fed’s 2024 median Core PCE forecast to 2.60% in the March Summary of Economic Projections. The Fed and markets now appear aligned on easing expectations, with Bloomberg’s interest rate probability model calling for three cuts as well.

Source: Bloomberg. Past performance is no guarantee of future results.

Near Term Rate Volatility to Remain High

Although a lower yield environment in 2024 appears likely, especially after moves from the SNB and with global inflation trending lower, we have certainly seen our fair share of false starts over the last year. We expect fixed income volatility will remain elevated until the markets gain more confidence that central bank easing is more broadly underway.

A prudent approach to fixed income investing calls for diversification across both credit and duration exposure. As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating fixed income for your clients, please contact Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Bill Smith serves as president, Portfolio Management & Trading, of Harmont Fixed Income in Phoenix.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Bank of Japan, Tokyo, Adobe Stock