First Cut Remains Elusive

Although rate cuts are still widely anticipated this year, recent data has pushed the expected start date further into 2024. The likelihood of a cut at the next Federal Open Market Committee (FOMC) meeting appears low, following comments from Federal Reserve Chair Jerome Powell that he doesn’t “think it’s likely that the committee will reach a level of confidence by the time of the March meeting” to adjust rates. Additionally, last week’s Bureau of Labor Statistics Consumer Price Index (CPI) report surprised to the upside with a 3.10% year-over-year read compared to the consensus estimate of 2.90%. This raises concern that the Fed’s path towards a 2% inflation target could be a bumpy one, and that rates may need to remain elevated for longer.

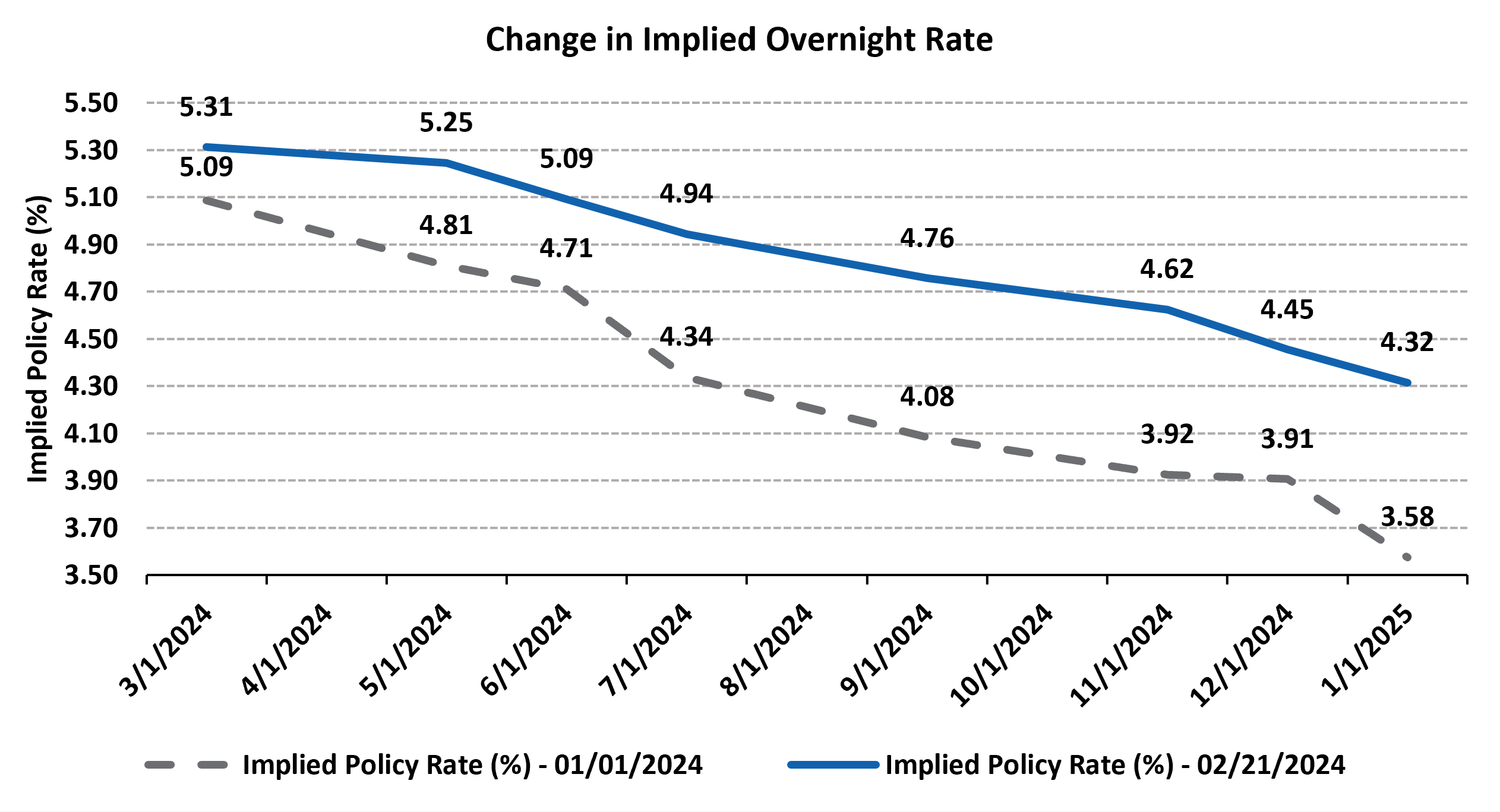

The odds of a cut in May are now just 35%, as estimated by Bloomberg’s interest rate probability model, leaving June’s FOMC meeting the more likely candidate, assuming inflation resumes its downward trend. This marks a significant shift in sentiment from the beginning of the year when expectations were high that easing could begin as early as Q1 2024, as illustrated in the “Change in Implied Overnight Rate” chart below.

Source: Bloomberg. Past performance is no guarantee of future results.

Bond Prices Have Trended Lower

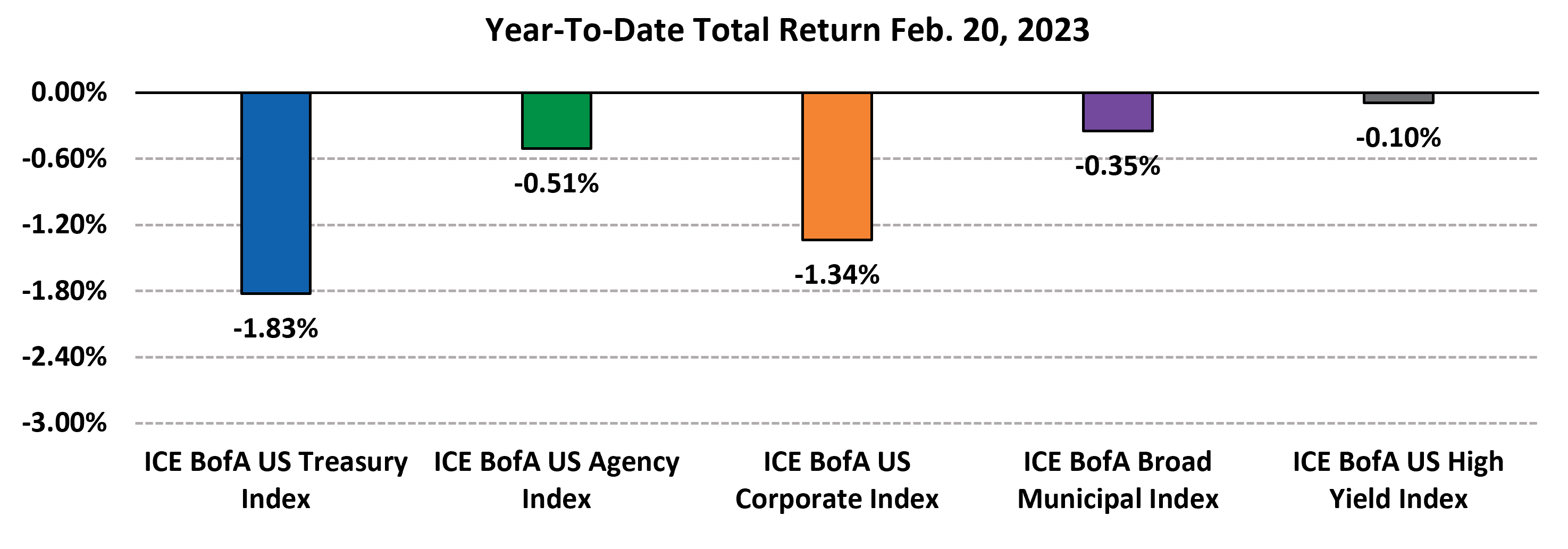

Bond prices generally declined in February as the fixed income markets digested the prospect of a delayed start to Fed easing. Year-to-date total returns are now negative across major fixed income indices, led by declines in Treasuries and investment grade corporate bonds. While slightly negative on the year, high yield continues to outperform as shown in the “Year-to-Date Total Return” chart below.

Source: ICE BofA Indexes, Bloomberg. Past performance is no guarantee of future results.

Lower Prices, Higher Yields

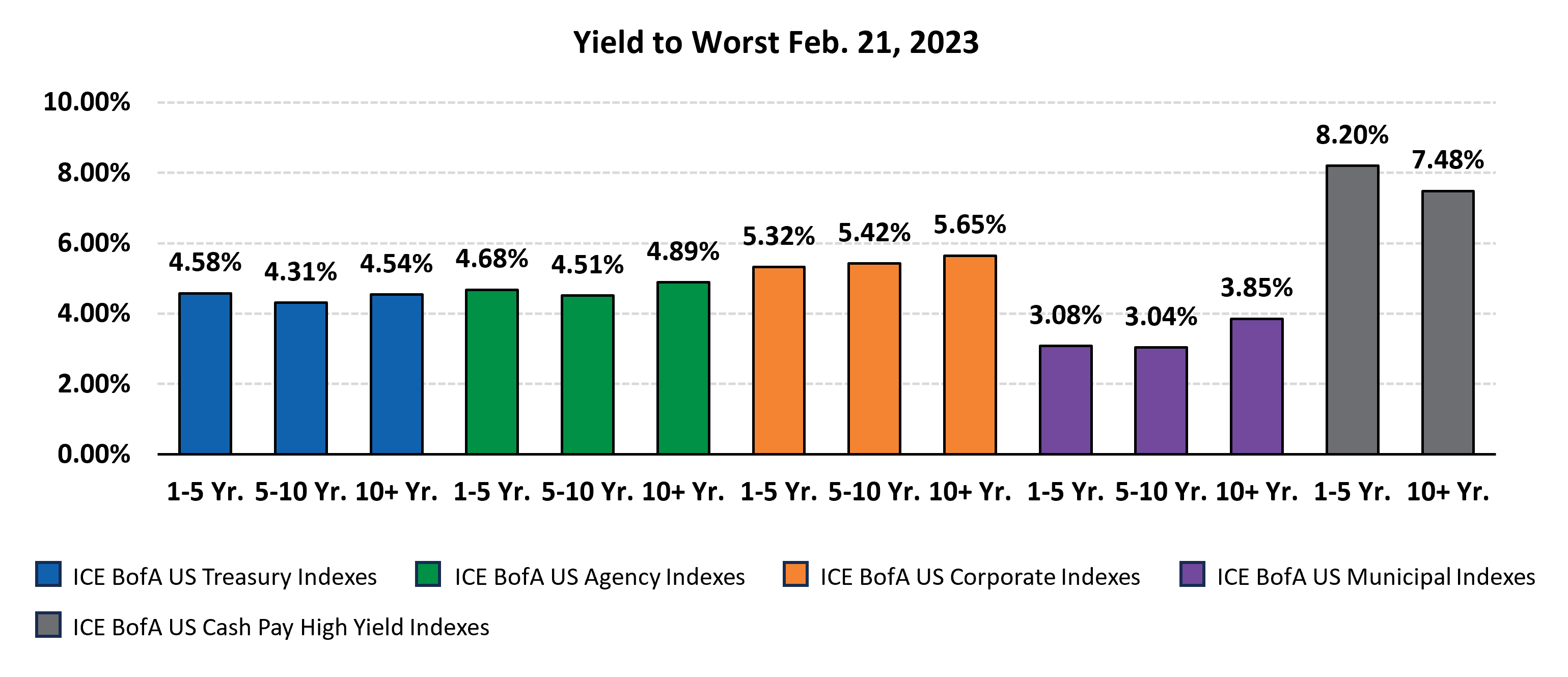

Recent price declines have increased yields to levels rarely seen over the last two decades, offering income investors an increasingly attractive entry point into the fixed income markets. The chart below, “Yield to Worst Feb. 21, 2023,” summarizes the current yield of select ICE BofA indexes broken out by maturity band.

Source: ICE BofA Indexes, Bloomberg. Past performance is no guarantee of future results.

Near Term Volatility to Remain High

Although a lower yield environment in 2024 continues to be our base case scenario, shifting rate expectations and February’s CPI surprise demonstrate the inherent uncertainty of future monetary policy. With a strong economy, low unemployment and inflation above the Fed’s 2% target, we expect volatility will remain elevated in the near term.

A prudent approach to fixed income investing calls for diversification across both credit and duration exposure. As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating fixed income for your clients, please contact Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Bill Smith serves as president, Portfolio Management & Trading, of Harmont Fixed Income in Phoenix.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock