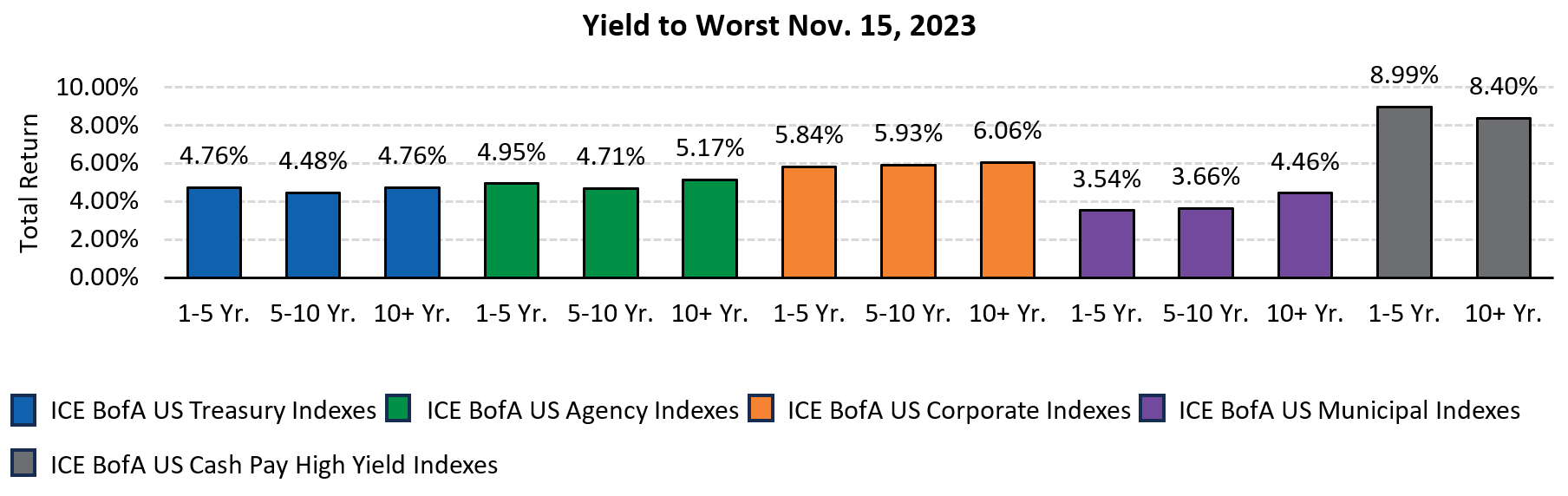

Yields Retreat but Remain Attractive

Fixed income volatility continued into November, driven by expectations that this tightening cycle may finally be coming to an end. Since our last Bond Market Update on October 20, 30-year Treasury yields decreased 37 basis points from 5.07% to 4.70%, and 10-year Treasury yields declined from 4.91% to 4.55% as of November 15.

Even with this pullback in yields, attractive income opportunities are still widely available across fixed income sectors and maturities. While volatility may remain high for the remainder of the year, we believe now is an exceptional time to look at fixed income. The following chart, “Yield to Worst,” provides a broad level overview of the current fixed income yield environment.

Source: ICE BofA Indexes, Bloomberg. Past performance is no guarantee of future results.

Potential Easing Around the Corner

According to Bloomberg’s current interest rate probability model (as of November 16), expectations for an additional rate hike this cycle have dropped to zero. Furthermore, the prospect for significant rate cuts in 2024 has increased. The model now estimates a 100% chance of at least one 25 basis point cut by June of next year, and a 100% chance of at least three by November. Should this scenario play out, the opportunity to lock in yields at these levels could be closing.

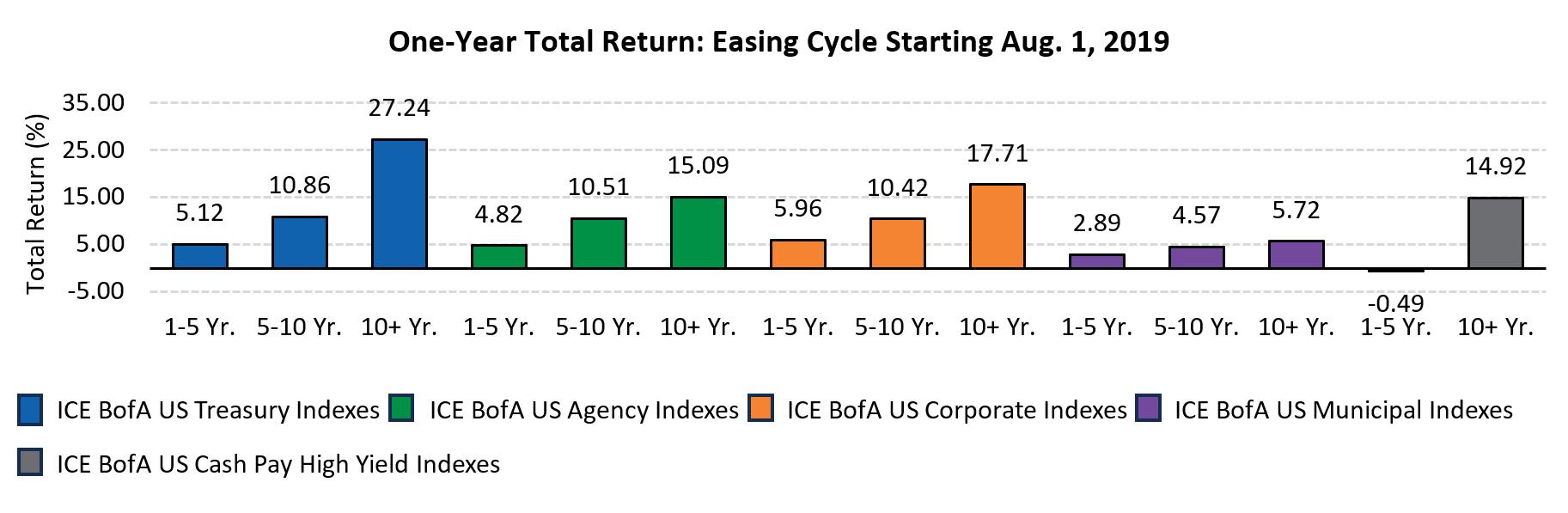

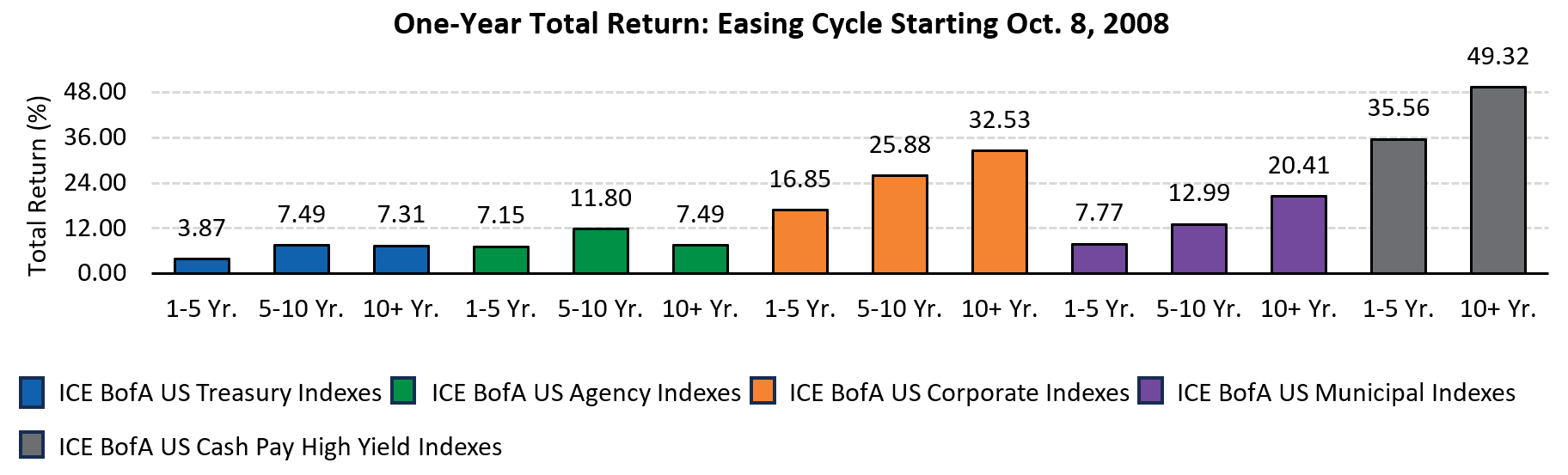

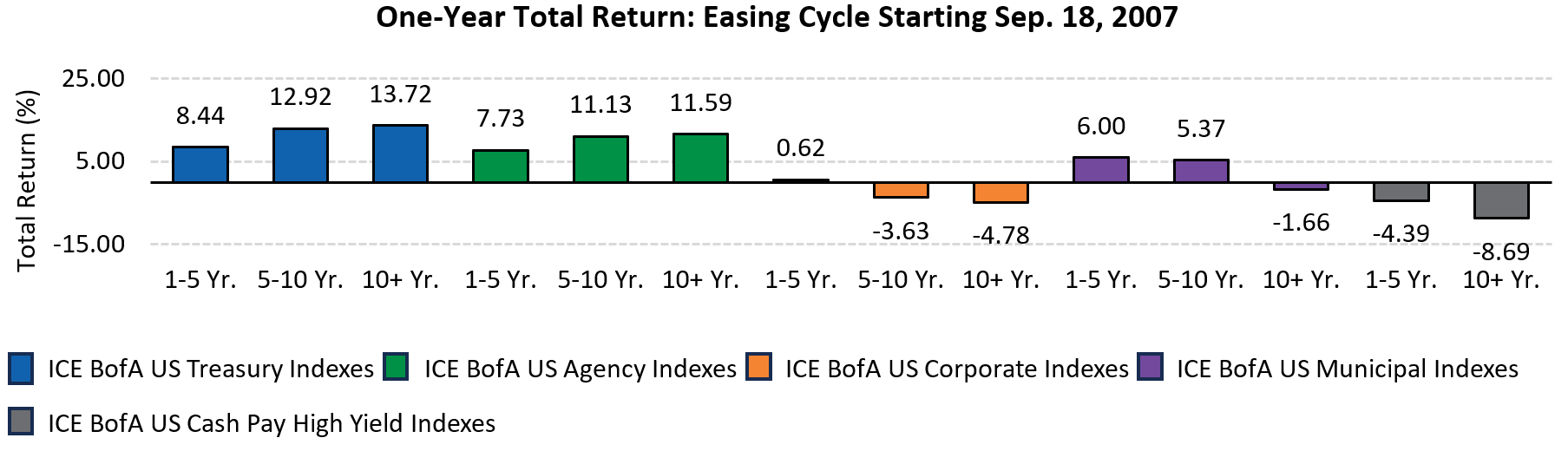

Falling Rates Could Bolster Total Returns

If interest rates decline, the potential for price appreciation in the bond market is robust. In general, bond prices move inversely with yields, meaning prices go up as rates decline and fall when rates rise. Intermediate and long bonds are more sensitive to this relationship, and often outperform shorter maturities when rates are falling.

The three charts below present the total returns for select bond indexes at the beginning of the last three Federal Reserve (Fed) easing cycles. For this analysis, we excluded the COVID-19 interest rate cuts in March 2020, as we believe this period is an outlier when compared to historical easing campaigns.

Source: ICE BofA Indexes, Bloomberg. Past performance is no guarantee of future results.

Source: ICE BofA Indexes, Bloomberg. Past performance is no guarantee of future results.

Source: ICE BofA Indexes, Bloomberg. Past performance is no guarantee of future results.

While the charts above illustrate the general tendency for intermediate and long maturities to outperform short during easing cycles, they also show this outperformance varies across fixed income sectors and economic environments. Since no two easing cycles are the same, and timing rate cuts can be difficult, we continue to recommend a diversified approach to maturity and sector selection. With attractive yields still broadly available, and market expectations for future rate cuts increasing, now is a compelling time to consider fixed income.

A prudent approach to fixed income investing calls for diversification across both credit and duration exposure. As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating fixed income for your clients, please contact Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Bill Smith serves as president, Portfolio Management & Trading, of Harmont Fixed Income in Phoenix.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock